Why the Office-to-Lab Conversion Trend Will Last

These redevelopments are no easy task. Experts told us when and why they make sense.

Once-bustling office buildings are now grappling with record vacancies, as the stickiness of remote work is changing the way we think about the asset class. In response to this shift, a compelling opportunity emerged in the form of office-to-lab conversions.

“Postpandemic, many office buildings remained partially vacant as work-from-home policies have allowed more flexibility and tenants began rightsizing their space,” said Austin Barrett, executive vice president & North America life science practice lead at Savills. “Landlords seized this lucrative opportunity to repurpose existing buildings that have the infrastructure to support lab conversions as they attracted higher rents.”

READ ALSO: Life Science Sector Faces Challenges, Yet Recovery Is in Sight

Cities such as Boston, San Francisco and San Diego—known for their biotech and pharmaceutical industries—are leading the charge, but the trend is quickly spreading to other areas. Mark A. Sullivan, architect & partner at JZA+D, noticed a surge in biotech research space demand along the New York City-Philadelphia corridor, driven largely by the concentration of research universities and entrepreneurial ventures in this region.

The motivations behind the office-to-lab conversion trend are clear and compelling.

“While commercial office space demand dropped during the pandemic, it expanded and intensified the demand for bioscience spaces since it encapsulated the kind of work that required specialized physical spaces and infrastructure that could not be transferred to home offices,” Jay Deshmukh, senior design-focused architect assisting health-care and corporate clients at Arcadis, told Commercial Property Executive. “In regions with a strong focus on the biosciences industry, especially those near hospitals and research-driven universities, the demand for lab spaces grew.”

What makes a building suitable for conversion?

Even though conversions make sense, not every office building is ripe for becoming lab space. Suitability depends on many factors, ranging from structural integrity to zoning regulations. For example, in San Francisco, the city’s Production, Distribution and Repair districts allow for laboratory occupancies under zoning laws, providing a good environment for such conversions, according to Charles Bloszies, expert on office building conversions at the Office of Charles F. Bloszies.

“It’s essentially another kind of light industrial use favored in the zoning, and developers like this opportunity. There is demand among potential commercial and institutional tenants for these spaces,” he said.

Sullivan believes that single-story or low-rise office properties classified as light industrial are prime candidates. These buildings often have higher ceilings, making it easier to install the specialized ventilation and HVAC systems needed for research environments.

Arcadis’ experience with biosciences tenants shows that there are at least five key factors enabling conversions:

- zoning rights which allow lab uses within the building

- service elevator access for movement of equipment and waste

- feasibility for augmenting HVAC and electrical systems to support lab functions

- ability to exhaust lab equipment and spaces per code requirements (within budgetary constraints)

- last but not least, location

Buildings with robust MEP systems, strong structural integrity and suitable clear heights to support overhead utilities are better suited, agrees Sharon Wilhelm, lab and facility planner at Savills. Additionally, access to loading docks, service elevators and ample water, gas and electrical services are crucial to facilitate the conversion process.

READ ALSO: You Bought an Office Building. Now What?

Buildings with adequate floor-to-floor heights and available shaft space are ideal candidates for lab space conversions, believes Walker Shanklin, director of architecture at SGA.

“The typical life science bay spacing is based on an 11-foot lab bench module, and the ideal floor-to-floor height is 14-and-a-half feet or taller, which allows for the necessary ductwork and mechanical systems required for lab environments,” he said.

Additionally, the overall structural integrity of a building is also essential, as lab spaces often need to accommodate heavy equipment and materials, so the building’s load capacity and structural stability must be considered early in the design phase, Bloszies pointed out.

Navigating conversion complexities

While the idea of converting vacant office buildings into lucrative lab spaces may seem a win-win, the financials and logistics can be highly complex. One of the biggest challenges developers face is upgrading the infrastructure. This can include anything from installing advanced HVAC systems to upgrading electrical capacities and even reinforcing floors to handle heavy lab equipment.

“Lab spaces require enhanced ventilation systems, which might involve utilizing abandoned shafts or creating new vertical areas,” said Shanklin. “Additionally, the need for increased power supply, specialized plumbing and additional water and sewer capacity all contribute to the higher costs associated with lab conversions.”

Developers must evaluate factors such as load capacities, floor-to-ceiling clearances and fire and safety systems to ensure that a building can handle these demands. In seismic zones like San Francisco, structural upgrades may be necessary to meet safety standards, including higher floor loading capacities and stiffer frames to reduce vibrations.

READ ALSO: Dos and Don’ts for Life Science Conversions

Sullivan underscored that conversions often require significant enhancements to electrical, water, waste and gas services. Some research types necessitate holding tanks and specialized drains for waste handling.

“It’s really about cost. The research organization or developer has to decide whether it’s going to be a better investment to convert an office property or build new somewhere,” Sullivan continued.

But despite the substantial upfront costs, the potential long-term financial benefits can make conversions a worthwhile investment. “From a landlord’s perspective, lab tenants often sign longer leases, providing more stability in a fluctuating market,” Barrett pointed out.

Office-to-lab conversions across the country

Several successful projects showcase how strategic planning, thoughtful design and careful selection of properties can lead to profitable office-to-lab conversions.

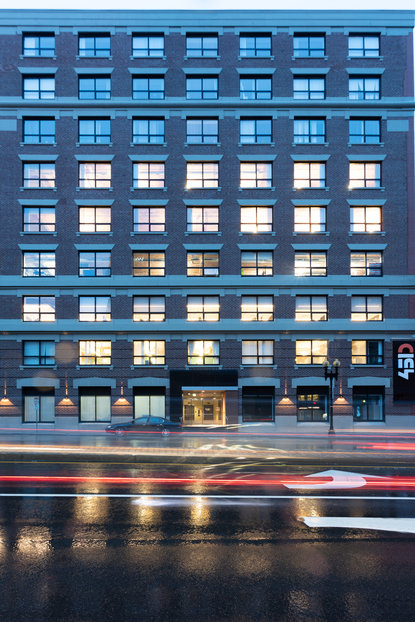

One standout example is 451 D Street in Boston, where a century-old office building underwent two major conversion phases, between 2020 and 2021. The first focused on turning 150,000 square feet of office space into Biosafety Level 2 lab facilities, while the next added another 75,000 square feet of specialized space.

READ ALSO: Attracting Life Science Tenants in Core Markets

Infrastructure improvements at the 477,000-square-foot property included rooftop air handling and exhaust systems with energy recovery, standby generators, updated hot water heating, new electrical distribution and plumbing systems for lab waste and nonpotable water. Today, the Related Beal-owned and -managed building houses multiple life science tenants.

Another success story comes from New Haven, Conn. Elm City Bioscience Center was an underutilized office building, eight stories high and encompassing 130,000 square feet. Svigals + Partners revitalized it and turned it into a biotech hub. To meet specific requirements, new mechanical, electrical and plumbing systems were installed, and today, the space includes shared and private laboratories, office spaces and amenity areas, all tailored to the specific needs of biotech companies.

But perhaps one of the most ambitious conversion projects is the Bridge Labs at Pegasus Park in Dallas. This former call center was recently transformed into a 135,000-square-foot life science and research facility. Located within the city’ first true biotech campus, the project addresses the growing demand for lab space in the Dallas-Fort Worth metro. With 30 percent already preleased, this project solidifies Texas as an emerging hub for biotech research.

A lasting impact?

As office-to-lab conversions continue to gain traction, the trend’s broader impact on the commercial real estate market is becoming more apparent.

In cities where demand for lab space is growing, the ripple effects are beginning to show. Barrett noticed that as more office spaces are converted into labs, the overall supply of office space decreases, which eventually leads to higher rents for those offices that remain, especially in prime locations where demand for traditional office use persists.

However, many landlords have been hesitant to undertake costly lab conversions without guaranteed tenant interest. So, after peaking in 2021, the surge in conversions started to slow down as more purpose-built life science buildings came to life. This could very well rebound once the current supply-demand balance gets closer to parity.

Looking ahead, developers are also taking steps to future-proof lab spaces, ensuring that these facilities can evolve with technological advancements and changing research needs. Shanklin and Deshmukh both noted that new lab designs are incorporating modular, flexible layouts to accommodate various research activities and future research technologies, such as data-intensive computational work or increased lab automation.

By future-proofing these lab spaces, developers are not only making them attractive to today’s biotech companies but also ensuring they remain relevant as research methods and technologies continue to evolve.

You must be logged in to post a comment.